Here are some of the top stocks to invest in right now, based on current market trends and performance. Keep in mind that investing always carries risks, and it’s important to conduct thorough research or consult with a financial advisor before making any decisions. The stocks listed below represent a mix of large-cap companies, growth stocks, and dividend-paying options that could be suitable for different types of investors.

1. Apple Inc. (AAPL)

- Sector: Technology

- Why Invest: Apple remains a market leader in technology with strong growth potential, particularly in its services sector, including iCloud, Apple Pay, and the App Store. Its consistent innovation and loyal customer base make it a long-term investment candidate.

- Growth Factors: iPhone upgrades, expansion in emerging markets, and continuous development of wearables and services.

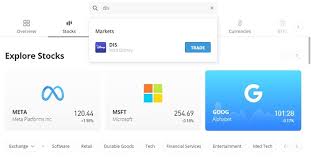

2. Microsoft Corporation (MSFT)

- Sector: Technology

- Why Invest: Microsoft’s cloud computing division, Azure, has seen tremendous growth, positioning the company as a leader in the cloud services space. Its diversified product portfolio, including Office 365 and LinkedIn, contributes to steady revenue streams.

- Growth Factors: Growth in cloud computing, AI integration, and software as a service (SaaS).

3. Amazon.com, Inc. (AMZN)

- Sector: Consumer Discretionary, E-Commerce

- Why Invest: Amazon continues to dominate e-commerce globally and has diversified into cloud services through AWS, which generates significant revenue. The company is also expanding into physical retail and healthcare.

- Growth Factors: E-commerce growth, AWS leadership, and potential in new markets like healthcare and logistics.

4. NVIDIA Corporation (NVDA)

- Sector: Technology, Semiconductors

- Why Invest: NVIDIA is a leader in the semiconductor industry, particularly in graphics processing units (GPUs), which are essential for gaming, AI, and data centers. The company is at the forefront of AI technology and autonomous driving.

- Growth Factors: AI advancements, gaming growth, and data center expansion.

5. Alphabet Inc. (GOOGL)

- Sector: Communication Services

- Why Invest: Alphabet, the parent company of Google, continues to lead the digital advertising industry while expanding into cloud services, AI, and autonomous vehicles. Its vast cash reserves allow it to innovate and invest in new opportunities.

- Growth Factors: Digital ad revenue, cloud computing, and AI investments.

6. Tesla Inc. (TSLA)

- Sector: Automotive, Renewable Energy

- Why Invest: Tesla is the global leader in electric vehicles (EVs) and renewable energy solutions. The company’s rapid expansion into energy storage and solar power, along with its dominance in the EV market, makes it a strong growth candidate.

- Growth Factors: EV market expansion, energy innovation, and global manufacturing.

7. Johnson & Johnson (JNJ)

- Sector: Healthcare

- Why Invest: Johnson & Johnson is a diversified healthcare giant with products ranging from pharmaceuticals to medical devices. Its stable dividend and solid performance in both consumer healthcare and drug development make it a safe, long-term pick.

- Growth Factors: Steady demand for healthcare, new drug approvals, and medical innovation.

8. Procter & Gamble Co. (PG)

- Sector: Consumer Staples

- Why Invest: Procter & Gamble is a well-known defensive stock with a strong portfolio of household products. The company is known for paying reliable dividends, and its ability to perform well during economic downturns makes it an attractive option for risk-averse investors.

- Growth Factors: Stable demand for consumer goods, pricing power, and brand loyalty.

9. Visa Inc. (V)

- Sector: Financial Services

- Why Invest: Visa is a leader in the global payments industry, benefiting from the ongoing shift towards digital payments. The company’s vast payment network and focus on innovation in financial technology make it a long-term investment opportunity.

- Growth Factors: Digital payment growth, fintech innovation, and expanding global payment systems.

10. Berkshire Hathaway Inc. (BRK.B)

- Sector: Financials, Conglomerate

- Why Invest: Managed by legendary investor Warren Buffett, Berkshire Hathaway is a diversified conglomerate with holdings in insurance, utilities, transportation, and various other industries. Its broad portfolio provides exposure to multiple sectors, making it a relatively safe long-term investment.

- Growth Factors: Strong management, diversified holdings, and long-term value investing.

Conclusion:

These stocks represent a variety of sectors and growth opportunities. When investing, always consider your personal financial goals, risk tolerance, and the broader market conditions. Diversifying your portfolio across different sectors can help mitigate risk and provide more stable returns over the long term.

11. Meta Platforms, Inc. (META)

- Sector: Communication Services, Social Media

- Why Invest: Meta, formerly known as Facebook, remains a leader in social media with platforms like Facebook, Instagram, and WhatsApp. The company is heavily investing in the metaverse and virtual reality (VR), positioning itself for future growth in the digital and augmented reality spaces.

- Growth Factors: Expansion of social media, VR/AR development, and the metaverse.

12. Pfizer Inc. (PFE)

- Sector: Healthcare, Pharmaceuticals

- Why Invest: Pfizer is a pharmaceutical giant known for its blockbuster drugs and vaccines, including the COVID-19 vaccine developed in partnership with BioNTech. With a strong pipeline of new drugs and consistent dividend payouts, it remains a solid pick in the healthcare sector.

- Growth Factors: Vaccine development, new drug launches, and healthcare demand.

13. Adobe Inc. (ADBE)

- Sector: Technology, Software

- Why Invest: Adobe is a leader in creative and marketing software with products like Photoshop, Illustrator, and the Adobe Creative Cloud suite. Its subscription-based model provides steady, recurring revenue, and its digital marketing tools are gaining traction with enterprises.

- Growth Factors: Growth in creative software demand, digital marketing, and SaaS expansion.

14. JPMorgan Chase & Co. (JPM)

- Sector: Financial Services

- Why Invest: JPMorgan is one of the largest and most well-managed banks in the world. It offers a diverse range of financial services, including investment banking, asset management, and consumer banking. Its strong balance sheet and leadership in the banking sector make it a reliable long-term choice.

- Growth Factors: Strong financial performance, leadership in investment banking, and global expansion.

15. Coca-Cola Co. (KO)

- Sector: Consumer Staples, Beverages

- Why Invest: Coca-Cola is a defensive stock known for its global brand recognition and wide product range. The company has a strong history of dividend payments and is diversifying its product lineup to include healthier options and non-carbonated drinks.

- Growth Factors: Global brand strength, diversification into healthier beverages, and strong dividend yield.

16. Walmart Inc. (WMT)

- Sector: Consumer Discretionary, Retail

- Why Invest: Walmart is the largest retailer in the world and continues to adapt to changing consumer trends, including the growth of e-commerce and delivery services. Its ability to perform well in both strong and weak economies makes it a stable choice for investors.

- Growth Factors: E-commerce expansion, supply chain innovation, and market dominance.

17. Netflix, Inc. (NFLX)

- Sector: Communication Services, Streaming Media

- Why Invest: Netflix is a global leader in streaming services, with a vast content library and strong international presence. The company’s investment in original programming continues to drive subscriber growth, and its foray into gaming presents new opportunities.

- Growth Factors: Global subscriber growth, original content success, and expansion into gaming.

18. Mastercard Inc. (MA)

- Sector: Financial Services

- Why Invest: Similar to Visa, Mastercard is a key player in the global payment processing industry. As digital payments continue to grow globally, Mastercard is well-positioned to benefit from the shift away from cash. Its focus on innovation in fintech also boosts long-term growth prospects.

- Growth Factors: Digital payments, global financial transactions, and fintech advancements.

19. PepsiCo, Inc. (PEP)

- Sector: Consumer Staples, Food & Beverage

- Why Invest: PepsiCo is a consumer staples giant with a diversified portfolio that includes beverages, snacks, and food products. The company’s strong brand portfolio and ability to consistently innovate with new products and healthier alternatives make it a reliable investment.

- Growth Factors: Global brand strength, product diversification, and stable demand.

20. Disney (The Walt Disney Company) (DIS)

- Sector: Communication Services, Entertainment

- Why Invest: Disney is a global leader in entertainment, with a diverse range of assets, including theme parks, movies, and streaming services (Disney+). The company is well-positioned for growth with the continued success of its content library and expansion into streaming.

- Growth Factors: Streaming growth, content creation, and theme park recovery post-pandemic.

Final Thoughts:

The current market offers a variety of opportunities for investors, ranging from tech giants like Apple and Microsoft to consumer staples such as Coca-Cola and PepsiCo. When selecting stocks, consider both your investment horizon and risk tolerance. Diversifying across different sectors and balancing between growth and defensive stocks can help ensure a more stable portfolio. Whether you’re looking for long-term growth or steady dividends, the stocks mentioned above offer a range of options to suit different investment strategies.

21. Taiwan Semiconductor Manufacturing Co. (TSM)

- Sector: Technology, Semiconductors

- Why Invest: Taiwan Semiconductor is a critical player in the global chip manufacturing industry, producing advanced semiconductors used in everything from smartphones to AI. As the demand for semiconductors grows, TSM is positioned to benefit from its technological leadership and dominance in the industry.

- Growth Factors: Growing demand for chips in 5G, AI, and electronics, as well as global supply chain dependence.

22. Costco Wholesale Corporation (COST)

- Sector: Consumer Discretionary, Retail

- Why Invest: Costco is known for its membership-based warehouse model, which offers bulk goods at competitive prices. The company has a loyal customer base, a strong focus on member retention, and a robust e-commerce platform, making it a solid investment choice in retail.

- Growth Factors: Membership model, strong e-commerce growth, and international expansion.

23. Boeing Co. (BA)

- Sector: Industrials, Aerospace

- Why Invest: Boeing is a leading aerospace manufacturer, and while it faced challenges during the pandemic, the global demand for air travel and aircraft is expected to rebound. The company is also involved in defense contracts, which add stability to its revenue streams.

- Growth Factors: Recovery in global air travel, new aircraft orders, and defense contracts.

24. PayPal Holdings, Inc. (PYPL)

- Sector: Financial Technology (FinTech)

- Why Invest: PayPal is a leading digital payments platform, facilitating transactions for consumers and businesses globally. As e-commerce and digital payments continue to grow, PayPal’s position as a trusted payment processor gives it a competitive edge in the fintech space.

- Growth Factors: Rise in e-commerce, digital wallet usage, and expansion into cryptocurrency.

25. NextEra Energy, Inc. (NEE)

- Sector: Utilities, Renewable Energy

- Why Invest: NextEra Energy is a leader in renewable energy, focusing on wind and solar power generation. As the world shifts towards cleaner energy, NextEra is well-positioned to benefit from this trend, making it an appealing investment for those seeking sustainable growth.

- Growth Factors: Renewable energy demand, government incentives for green energy, and sustainable infrastructure investment.

26. Intuitive Surgical, Inc. (ISRG)

- Sector: Healthcare, Medical Devices

- Why Invest: Intuitive Surgical is a pioneer in robotic-assisted surgery, with its da Vinci surgical systems used globally. The company’s innovative technology and growing adoption of robotic surgery in healthcare make it a promising long-term investment.

- Growth Factors: Technological innovation in healthcare, increased use of robotic surgery, and global expansion.

27. AT&T Inc. (T)

- Sector: Communication Services, Telecommunications

- Why Invest: AT&T is a major player in the telecommunications industry, offering a wide range of services from wireless to entertainment through its WarnerMedia division. While it faces competition, its extensive network and 5G rollout provide growth potential.

- Growth Factors: 5G adoption, media streaming growth, and telecommunications demand.

28. American Tower Corporation (AMT)

- Sector: Real Estate, Infrastructure

- Why Invest: American Tower is a leading REIT that owns and operates wireless communication towers globally. As mobile data consumption and 5G technology expand, the demand for wireless infrastructure is expected to rise, making AMT a solid long-term bet.

- Growth Factors: Global 5G rollout, mobile data growth, and infrastructure demand.

29. Lockheed Martin Corporation (LMT)

- Sector: Industrials, Aerospace & Defense

- Why Invest: Lockheed Martin is a top defense contractor, providing advanced technologies to governments worldwide. With strong defense spending in the U.S. and internationally, the company has consistent revenue streams and a history of dividend payments.

- Growth Factors: Global defense spending, military technology innovation, and government contracts.

30. Uber Technologies, Inc. (UBER)

- Sector: Technology, Transportation

- Why Invest: Uber is a leader in the ride-sharing and food delivery industries. While it faced significant challenges during the pandemic, the company’s expansion into freight and autonomous driving technology presents new growth avenues as mobility demand returns.

- Growth Factors: Recovery in global mobility, food delivery expansion, and development of autonomous vehicles.

Diversification and Risk Management:

It’s important to remember that investing in individual stocks carries risk, and the market can be volatile. Diversification across sectors — such as technology, healthcare, consumer goods, and energy — can help mitigate risk and provide a more balanced portfolio. Additionally, consider your investment horizon and whether you’re seeking growth or income through dividends.

Staying informed about market trends, technological advancements, and economic conditions will help guide your investment choices. While past performance is no guarantee of future results, these stocks are positioned to benefit from long-term economic and technological shifts, making them worthy of consideration for a well-rounded investment strategy.